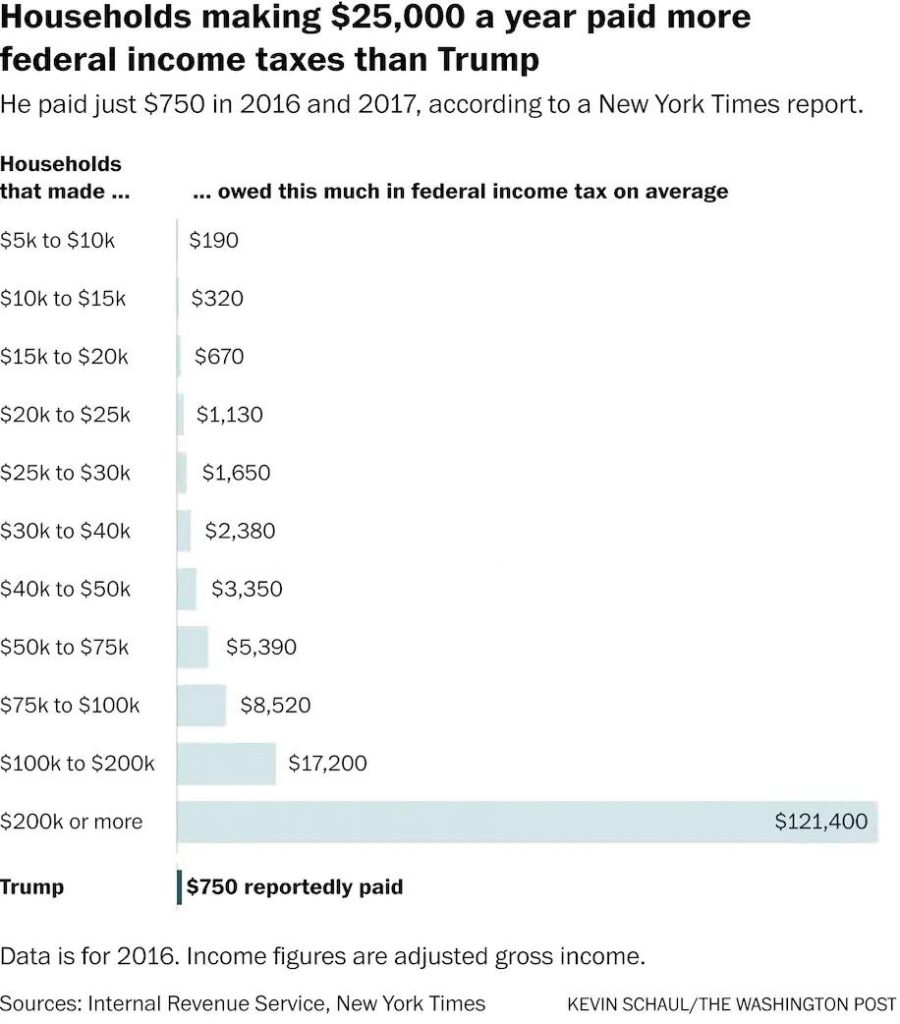

The country is perplexed. We have learned that almost all of us pay more taxes than the president. We have learned this from a reliable source, The New York Time, whose well-founded investigative reports, based on Trump’s tax returns, for more than a decade, have shown that the billionaire paid a total of $1,500 (to be precise, $750 in 2016 and 2017). The average American middle-class household (that of nurses, teachers, police officers, or manual workers) pays no less than $5,000 a year. Almost seven times more.

The revelation is accompanied by other disturbing data: the head of state owes private lenders 420 million dollars.

How can a billionaire, who operates in the real estate and casino markets in large hotels, pay almost zero taxes for a decade? The average effective tax rate in such sectors, among money-generating companies, has been 22% for real estate developers; and 17% for hotels and games, according to research by the NYU Stern Business School. Therefore, either Trump is involved in evasive and abusive tax planning, (against the country he governs!) or his companies are losing money massively … in times of economic expansion, since the country has been out of recession since 2009.

Only two options can be concluded, in light of Trump’s tax returns, either he has broken the law or is a terrible businessman. But this is not what’s most alarming. Ultimately, whether Trump has defrauded the state or is a pitiful businessman, these are personal issues. Serious, without a doubt, but individual. The truly devastating thing emerges when it is assumed that, as Trump and his defenders argue, that sum of $750 a year of taxation is adjusted to the law. If this is so, we are facing an aberration, since in that case the system is working to benefit the wealthiest, at the expense of the working and middle class, who pay an average effective tax rate of 19.7%, according to research and data from Americans for Tax Fairness (nonpartisan organization).

Beyond the arena of taxes and tax policy, no one has clarified who the private (non-bank) creditors are, of the $420 million owed by the President of the United States. A commitment that, given the investiture of the debtor, is a matter for the entire citizenry.

These two issues should, without a doubt, be among the priorities of the electoral debate. If the ethical requirement that must weigh on the ruler is not enough, then the current situation should stand out, in which the fiscal deficit grew, from 2.8% to 4.8% of GDP, during the last three years, after Trump and the Republican Party cut taxes on America’s largest and wealthiest corporations. And if this does not cast an ominous shadow on the president who is running for re-election, take into account the social unrest caused by the fact that unfair taxation, evaluated in research by the Institute for Economic Policy, is one of the drivers of income inequality in the United States.

Whatever way one looks at it, there is no way to glance at Trump’s tax returns and not feel that there is something very anomalous in the landscape. And if society lets this pass, it will become an accomplice to its own detriment. More than just economically, morally.

Photo: BBC