WASHINGTON, D.C. (July 18, 2024) — Today, the Minority Business Development Agency (MBDA) hosted its second annual Access to Capital Summit at the U.S. Department of Commerce. The Access to Capital Summit: Equity in Action convened national banks, investors, trade associations and the government entities that regulate these institutions to discuss trends that affect capital formation for minority business enterprises (MBEs).

Every year, this congressionally mandated forum works to foster a collaborative environment where these stakeholders can share insights, perspectives, and strategies that are being employed to revert disparities, and improve lending and equity investment for MBEs. The event has installed after Congressman Gregory Meeks from NY delivered opening remarks, indicating the important role MBDA plays in creating equitable growth and opportunities in our economy.

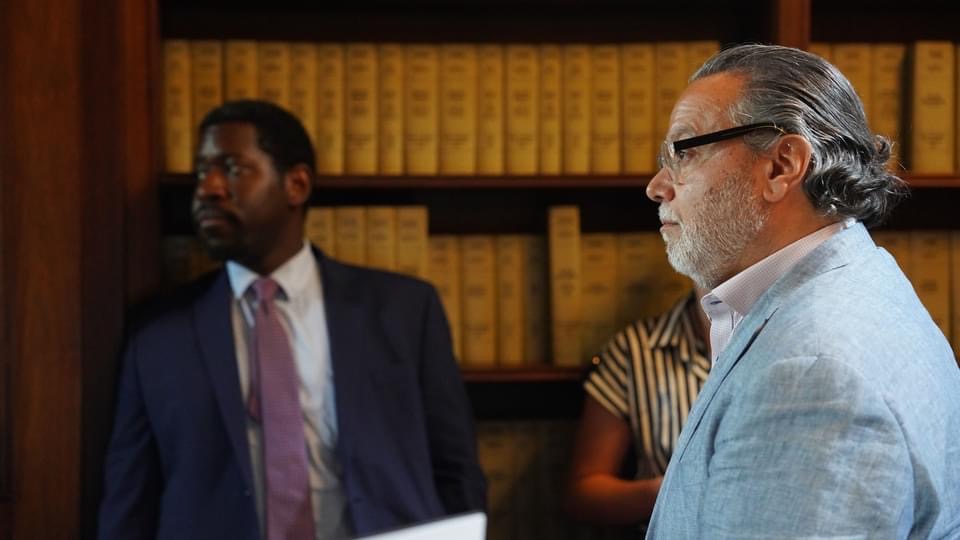

“The Minority Business Development Agency and the Department of Commerce are committed to ensuring all people have the resources, access, and opportunities necessary to succeed,” said Eric Morrissette, Acting Under Secretary of Commerce for Minority Business Development. “Our agency is perfectly positioned to help solve some of the greatest challenges alongside major players in the financial arena, and our annual Access to Capital Summit is just one tool we’ve been empowered to use to make these challenges a thing of the past.” During his opening remarks, Acting Under Secretary highlighted the leadership of Leopoldo Martinez, Senior Counselor at Commerce Department, and a known quantity on the subject of financial inclusion, for organizing and preparing the convening.

The Summit included three separate panel discussion, with noted leaders from various private and federal institutions:

Panel One: The Banks, MDI and CDFIs Perspectives

• Robert Schapira, Senior VP, Director of Small & Business Banking Diverse Customer Segments, WELLS FARGO

• Eva Brown, Head of Community Reinvestment and Strategic Partnership, BMO

• Calixto Garcia-Velez, President & CEO, BANESCO USA

• Luz Urrutia, President & CEO, ACCION OPPORTUNITY FUND

Panel Two: FinTechs and Equity Players Perspectives

• Sadip Nayak, President, QUANTUM FINANCIAL TECHNOLOGIES

• Kelly Cochran, Deputy Director, FINREG LABS

• Ashlyn Roberts, Senior Director of Government Relations of the National Venture Capital Association (NVCA)

Panel Three: The Government Regulators Perspectives

• David Kaufmann, Community Development Manager at the Federal Reserve Board(FED)

• Andrew Moss, Director of Minority Outreach, National Director of Project Reach,Office of the Comptroller of the Currency (OCC)

• Betty Rudolph, Director, Office of Minority and Community Development Banking, Federal Deposit Insurance Corporation (FDIC)

• Julie Davis, Senior Special Counsel, Office of the Advocate for Small Business Capital Formation, Securities and Exchange Commission (SEC)

Deputy Secretary of Commerce Don Graves delivered closing remarks, during which he pointed to the critical role MBDA plays under its legal authorities to advocate and ensure “that minority-owned business have the tools, resources, and support they need to not just take part in, but drive the economic sucess of our country”. He also underscored, together with Actong Under Secretary Morrissette, the positive impact MBDA has has with its Capital Readiness Program.

About the Access to Captial Summit

MBDA’s Access to Capital Summit is an annual diverse business forum on capital formation mandated by the Minority Business Development Act of 2021. This government-business forum reviews the current status of problems and programs related to capital formation by MBEs.

About the Minority Business Development Agency (MBDA)

The U.S. Department of Commerce, Minority Business Development Agency is the only Federal agency dedicated to the growth and global competitiveness of U.S. minority business enterprises (MBEs). For more than 50 years, MBDA’s programs and services have better equipped MBEs to create jobs, build scale and capacity, increase revenues, and expand regionally, nationally, and internationally.